Taxes on personal income – Luxembourg

Individual income tax is levied on the worldwide income of individuals residing in Luxembourg, as well as on Luxembourg-source income of non-residents.

Enlightened by: Wissam Mobayyed

Personal income tax rate

Luxembourg income tax liability is based on the individual’s personal situation (e.g. family status). For this purpose, individuals are granted a tax class. Three tax classes have been defined:

- Class 1 for single persons.

- Class 2 for married persons as well as civil partners (under certain conditions).

- Class 1a for single persons with children as well as single taxpayers aged at least 65 on 1 January of the tax year.

As of 1 January 2018, married non-resident taxpayers who are not separated are granted tax class 1. However, subject to some conditions, they can request to be treated as Luxembourg tax resident to obtain the application of the tax class 2 (generally, the tax class for resident unseparated spouses). The application of tax class 2 leads to a combined assessment.

Non-resident taxpayers may request joint taxation under tax class 2 (i.e. as for married resident taxpayers), provided that at least one of the following conditions is met:

- 90% of the worldwide income of one spouse is taxable in Luxembourg. When assessing whether this is the case, the first 50 days that are not taxable in Luxembourg according to a double tax treaty (DTT) are treated as income taxable in Luxembourg.

- The income of one taxpayer taxable outside Luxembourg does not exceed 13,000 euros (EUR).

- For Belgian residents, the rules are less restrictive. Only 50% of the household’s professional income need to be taxable in Luxembourg.

This option can be requested via either payroll or individual tax return. Non-resident married taxpayers will have to report their non-Luxembourg-sourced income (for example, the spouse’s professional income). Such non-Luxembourg-sourced income will be exempted for Luxembourg tax purposes but will be taken into account when determining the applicable tax rate for the Luxembourg-sourced income (‘exemption with progression’).

In practice, married non-resident taxpayers where one spouse works outside of Luxembourg and/or where the individual has extensive income outside of their Luxembourg employment income will be adversely affected by this provision, as it will increase their effective tax rate.

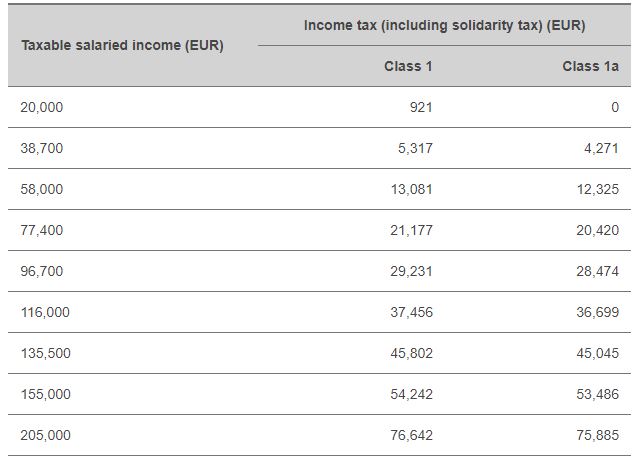

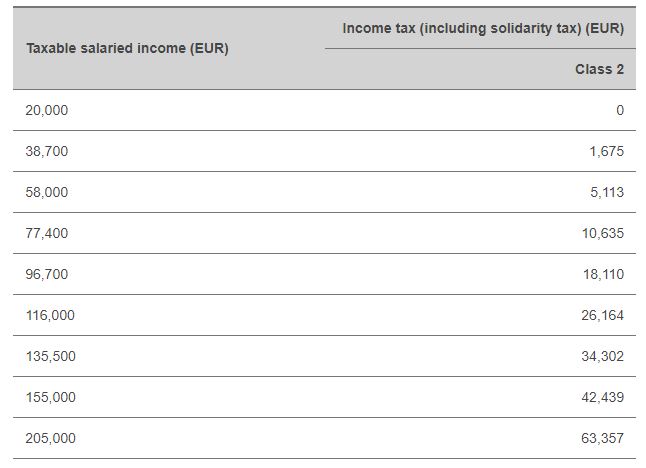

Tax is calculated in accordance with a progressive table, ranging from 8% on taxable income in excess of EUR 11,265 to 42% on income in excess of EUR 200,004 for 2018. A solidarity tax of 7% of taxes (9% for taxpayers earning more than EUR 150,000 in tax class 1 and 1a or more than EUR 300,000 in tax class 2) must also be paid.

Single taxpayer (Class 1/Class 1a) :

Married taxpayer (Class 2) :

For more information please contact us:

Tel: +352 2 7765000

Email: info@ascot-management.com

9 Avenue du Blues L-4368 Sanem,

Grand Duchy of Luxembourg